The brief provides a short overview of a project in which Deutsche Bank Research has combined its own foresight expertise with inputs from the bank’s business strategists and external experts in order to develop scenarios for the future development of the German economy and society against the backdrop of intensifying structural change.

Germany on the Path toward a “Project Economy”

Deutsche Bank and its clients require knowledge about the future for their investment decisions. Deutsche Bank Research provides this “corporate foresight”. A multidisciplinary team develops and applies a wide range of methods to identify longterm macro trends. These foresight results, which are achieved on the basis of structured, process-based, quantitative and qualitative analyses, are fed into discussions with strategic management and clients as well as into public debate on broader economic, societal and political issues. The next two decades will be crucial for determining the path Germany will take over the long-term. Will German society be able to cope with the demographic pressures bearing down on the economy and the state’s finances? Will Germany succeed in redefining its role in the rapidly changing global economy and world order? Will Germany be a leader or a laggard on the road to a knowledge economy? Our first step was to sketch four alternative scenarios outlining how the German economy and society may have developed by the year 2020 (“Expedition Deutschland”, “Wild West”, “Drawbridge Up” and “Skatrunde (Playing Cards) with the Neighbours”). In the second step, we used broadly-based trend analysis to examine which of these four future scenarios is the most plausible.

The “Expedition Deutschland” Scenario – Knowledge and Cooperation Are Critical

The core elements of the “Expedition Deutschland” scenario for 2020 (formulated from the perspective of the year 2020) are the following:

In 2020, the “project economy” delivers 15% of value creation in Germany (in 2007 the figure was about 2%). The “project economy” refers to usually temporary, extraordinarily collaborative

and often global processes of value creation. For many companies, this type of cooperation is in many cases the most efficient way of doing business. This is because product life cycles have shortened further; the breadth and depth of the knowledge necessary for developing and marketing successful products have increased rapidly; successful products are increasingly the result of convergence between different fields of technology and knowledge; and many companies and research institutes are even more strongly specialised in 2020 than they were in 2007. Consequently companies collaborate ever more frequently on joint projects, often in the form of legally and organisationally independent project companies. They delegate specialised employees or parts of their organisation to these projects, invest capital or put their knowledge and networks at their disposal. In this way, companies can respond flexibly to the considerably higher demands on knowledge and rapidity in the global markets while sharing the costs and risks. This is often – but by no means always – their key to success: in 2020, too, collaboration generates considerable personal and strategic tensions. Factors that help to reduce the frictions on the technical side are mature, highly standardised information technologies. The project economy is closely intertwined with the traditional way of doing business. In 2020, many companies are continuing to go it alone with the market launch of their products. Often, though, these same companies cooperate in other markets – for instance the innovation-intensive ones – by taking the project economy approach. Germany’s small and mediumsized enterprises (SMEs) benefit in particular from the project economy. SMEs can use their advantages of specialisation and organisational flexibility – and are additionally boosted by a renewed surge in start-up activity. Open innovation processes helped to conquer new markets. In 2020, Germany has caught up with its competitors in markets for cutting-edge technology and knowledge-intensive services. Today, innovation is Germany’s core competence, with “Created in Germany” often being first choice, especially in Asia and the Middle East. Some of the main reasons for this success are collaborative innovation as well as intelligent sharing and exchange of knowledge and intellectual property. A project- economy approach to work has proved efficient especially in the early innovative and thus particularly knowledgeintensive phases of value creation. Moreover, many German corporations (and their local and international project companies) have benefited over the past few years from having more closely integrated the generation of “sovereign customers” into their processes. These customers are well networked via interactive forums and have up-to-date knowledge of prices and qualities in the areas that interest them. By contrast, many business investments in long-term research and development will have fallen by the wayside by 2020. They are often poorly adapted to the more short-lived valueadded patterns of today. Knowledge is traded in efficient markets in 2020. Knowledge

about customers, markets and many other topics is valued and traded much more efficiently today than back in 2007. The operators of such knowledge-based services are flourishing. Intellectual property has become a commonly used asset class:

investors may choose from a broad spectrum of topic-oriented patent funds, copyright securitisations etc. Moreover, intellectual capital has swung into the focus of company valuations:

the capital market now takes interest not only in a company’s traditional balance sheet ratios but also its research efficiency, education and training budget, and cooperation ratings.

The young and seasoned minds that house this intellectual capital benefit from efficient learning markets in 2020. Private operators of learning services prosper. Also, the public universities and other educational facilities have become more efficient following a wave of consolidation. Furthermore, they are more strongly involved in the market for modular education and training.

From Direct Regulation to Co-regulation

Government reduces its intervention and there is more coregulation. Co-regulation closely integrates citizens and companies. On the one hand, legitimation problems have motivated the state and still tight fiscal constraints have compelled it to cede part of its mandate to others. On the other, the regulatory issues have become increasingly complex. More than ever before, the state needs to tap the knowledge of citizens and companies to be able to set suitable framework conditions. Regulatory regimes that emerge in this way are more intelligently geared to the needs of business and society. They are more transparent for people and companies alike and ease the struggle into new markets. In general though the state’s abandonment of parts of its mandate has resulted in social transfers now coming with strings attached. In addition, more and more social services (e.g. long-term care) are organised on a private basis. Germany has become a “stakeholder society” based on reciprocal action.

Successful New Middle Class – Low Earners Lose Out

A new middle class emerges in German society by 2020, but the lower periphery falls behind. The middle class celebrates its comeback. The new opportunities for upward social mobility and the higher risk of social decline, both being the consequence of increasingly global and volatile value creation, have clearly shown the middle class the value of knowledge. Many Germans with a mid-range income therefore invest heavily in education – and thus gain qualifications for the demanding, but at the same time well-paying jobs in the project economy.

Well-educated older people also benefit as they are intelligently integrated in the working world in 2020. By contrast, low earners have only limited access to the new learning markets, and young and old alike often have to fear for their livelihoods. International competition has an even more incisive impact on this group than on others. Many low earners are compelled to organise themselves in self-help networks and many have lost their faith in politicians.

Globalisation, Diversification in Energy Supply and Digitisation Are Other Key Trends

These elements, however, are interrelated with three other aspects of structural change which are already well under way and which, in our view, have rather trend-like characteristics.

― Globalisation leads to new centres of gravity in the international value creation chain.

― Energy supply shows a broader mix and decentralised production.

― Digitisation enables networked goods flows in the new Internet.

Given the structural changes outlined here on the way to “Expedition Deutschland”, we expect Germany’s gross domestic product to grow at an average rate of 1.5% per year up to 2020. From a 2007 perspective, these changes will pave the way to extraordinary opportunities for business, society and politics, but also harbour substantial risks. Some key fields of action for business include, for instance, a structured analysis of collaboration options, a more systematic assessment of intangible investments, broader acceptance of new forms of education and training, and an increase in life-long learning activities.

Innovative Methodology to Deal with High Complexity in Scenario Analysis

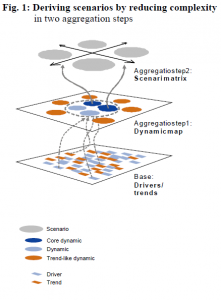

The guiding question for our scenario analysis is how will structural change have affected the German economy by the year 2020? In order to answer this question, we applied a methodology based on a simple scenario approach. Normally, one identifies the two key drivers to build a “scenario matrix”. Each field in the scenario matrix represents a different combination of attributes (high/high, high/low etc.) of these two drivers, and one scenario is developed from each of their respective interactions (see Figure 1, for an overview of the different elements of our scenario analysis see box on page 4). In addition to these drivers, whose future development is uncertain, there are a number of trend-like drivers – whose future development is comparatively predictable (in the following they are referred to for short as “trends”) – which impact on all four scenarios. These trends show similar developments in all four scenarios.

But our scenario question is multi-faceted; the number of relevant drivers and trends is high. To cope with this complexity without losing too much information, we have advanced the above approach: we have aggregated drivers that are thematically related and whose development is correlated into “dynamics” (the trends, too, are aggregated into “trend-like dynamics”, see the figure Deriving scenarios by reducing complexity). Instead of taking individual drivers, we build the scenario matrix with the two key dynamics. Further information and a discussion of the merits and drawbacks of this approach can be found at www.expeditiondeutschland.de/en.

Nonetheless, through interaction with the other drivers, the trends can develop or impact slightly differently or at a different pace in each scenario.

In the scenario method these drivers are often referred to as “determinants” and the trends as “premises“.

Concept of the “Most Plausible Scenario”

Classic scenario analysis examines alternative future developments – but without highlighting any one of the depicted scenarios as the most probable scenario. For good reason since the scenario method does not in itself deliver any (or sufficient) indications as to which picture of the future is the most probable.

We are deliberately breaking with tradition of future research here: we identified a number of trends or trend-like dynamics that have an exceptionally strong influence and whose general future development can be predicted particularly reliably. They are driving Germany in the direction of one of our four scenarios and therefore make it particularly plausible. We refer to this scenario as the focus scenario and call it “Expedition Deutschland“. These trends relate to developments in a broad spectrum of fields in business, society and politics as well as in science and technology. They partly reinforce each other, a factor that has further encouraged us to focus on this one scenario.[1]

[1] We have systematically analysed the interactions between many of these trends in the earlier project “Global Growth Centres 2020” (see Bergheim, Stefan (2005), loc. cit.).

Our focus on this scenario should therefore not be seen as a normative statement: our message is not that we are placing this scenario in the spotlight because it is the “most desirable” one in our view. But, despite all the plausibility bonuses derived from our trend analysis in favour of this scenario over the other three, the following needs to be stressed:

Our focus scenario is not a forecast. In 2020, Germany will look only in parts like we have described in our scenario. Rather, there will be a mix of elements of all four (and maybe other possible) scenarios.

Elements of our scenario analysis

— “Driver”. Important factor of influence on future structural change in Germany whose future development is difficult to predict.

— “Trend” (trend-like driver). Important factor of influence on future structural change in Germany whose future development is reliably predictable.

— “Dynamic”. Aggregation of (mostly non-trend-like) drivers which are thematically related and whose development is correlated. The future development of a dynamic as a whole (without drawing on additional information) is difficult to predict.

— “Trend-like dynamic”. Aggregation of (mostly trend-like) drivers that are thematically related and whose development is correlated. The future development of a trend dynamic as a whole is reliably predictable.

— “Scenario”. An, in itself, consistent picture of the future (in this case of the German economy and society) derived from a

given combination of developments of the dynamics considered (and the expected developments of the trend-like dynamics). “Consistent“ means here that the interaction of the various elements has been taken into account.

— “Focus scenario”. The one of our four alternative scenarios for Germany in the year 2020 which we consider to be the most plausible owing to the future impact of some of the above “trends“ and “trend dynamics“.

Our message is that, as far as we can judge today, it appears plausible that Germany is more likely to resemble our focus scenario than the other pictures of the future developed here.

Illustration of the Scenarios

We have developed posters to sum up the content and convey an intuitive image of the key messages of our four scenarios. They depict the behaviour of businesses and citizens (as persons), the market playing field (as environment/terrain) and the regulatory framework (as sky/weather) in 2020. To give an example, here we show the poster for the “Expedition Deutschland” scenario discussed above.

| Authors: | Jan Hofmann jan-p.hofmann@db.com; Ingo Rollwagen ingo.rollwagen@db.com; Stefan Schneider stefan-b.schneider@db.com | ||||

| Sponsors: | n.a | ||||

| Type: | n.a | ||||

| Organizer: | Deutsche Bank Research | ||||

| Duration: | 2006 – 2008 | ||||

| Budget: | n.a. | ||||

| Time Horizon: | 2020 | ||||

| Date of Brief: | January 2008 | ||||

Download: EFMN Brief No. 146_Germany 2020

Sources and References

- expeditiondeutschland.de/en

- dbresearch.de